Here’s a helpful list of First-time Home Buyer Do’s and Don’ts to guide you through one of the biggest decisions of your life:

✅ DO’s for First-Time Home Buyers

- ✅ Get Pre-Approved for a Home Loan

- Know your budget and improve your negotiating power.

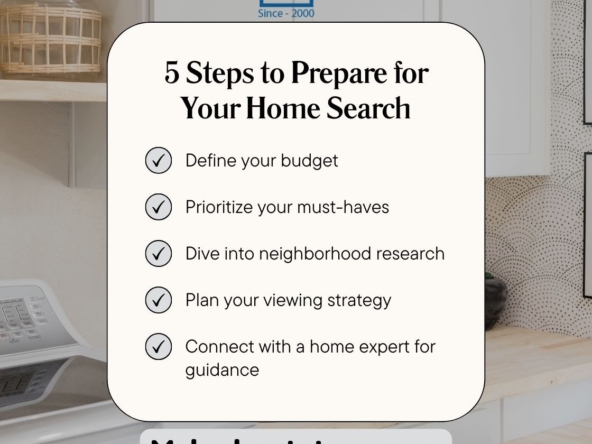

- ✅ Set a Realistic Budget

- Include not just the home cost but also taxes, maintenance, registration, society charges, and furnishing.

- ✅ Research the Local Market

- Understand area prices, upcoming developments, builder reputation, and infrastructure plans.

- ✅ Hire a Trusted Real Estate Agent

- A professional can help with price negotiation, paperwork, and property selection.

- ✅ Inspect the Property Thoroughly

- Check the structure, plumbing, electricals, ventilation, Vastu (if important to you), and legal clearances.

- ✅ Prioritize Location

- Choose based on connectivity, safety, future appreciation, and proximity to schools, hospitals, and work.

- ✅ Understand All Legal Documents

- Verify property title, occupancy certificate, RERA registration, and society approvals with a legal expert.

- ✅ Think Long-Term

- Choose a property that suits your future needs like family planning or remote work.

❌ DON’Ts for First-Time Home Buyers

- ❌ Don’t Rush the Process

- Emotional decisions can lead to regret. Compare multiple options before finalizing.

- ❌ Don’t Overstretch Your Budget

- A dream home shouldn’t become a financial burden. Always have an emergency buffer.

- ❌ Don’t Skip Loan Comparisons

- Compare interest rates, processing fees, and terms from different banks or housing finance companies.

- ❌ Don’t Ignore Additional Costs

- Avoid surprise expenses like stamp duty, maintenance, parking, registration, and GST (if applicable).

- ❌ Don’t Rely Solely on Online Listings

- Visit the property in person. Photos can be misleading.

- ❌ Don’t Forget Future Resale Value

- Choose a locality with good appreciation potential and demand.

- ❌ Don’t Make Verbal Agreements

- Always get everything in writing – including payment terms, possession date, and inclusions.