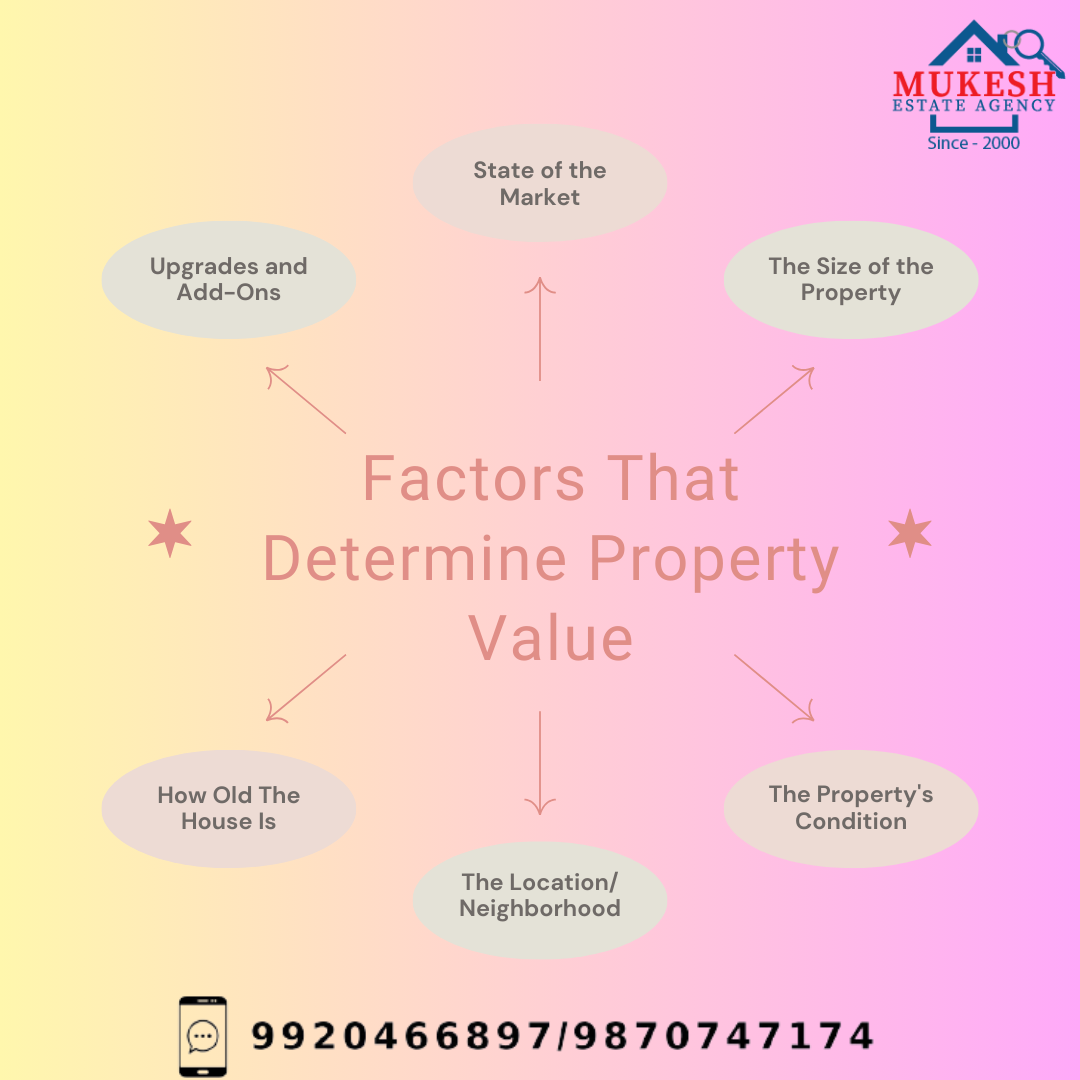

Property value is determined by a combination of factors, which can be broadly categorized into location, physical characteristics, economic conditions, and regulatory environment. Here’s a detailed breakdown of these factors:

📍 1. Location

Neighborhood Quality: Proximity to amenities such as schools, parks, shopping centers, and restaurants can significantly influence property value.

Proximity to Workplaces: Properties closer to major employment hubs tend to have higher values due to reduced commute times.

Crime Rates: Lower crime rates generally lead to higher property values.

Views and Scenery: Properties with scenic views or situated in aesthetically pleasing areas tend to be more valuable.

Accessibility: Ease of access to public transportation, major roads, and highways can increase property value.

2. Physical Characteristics

Size and Layout: The overall size of the property, number of bedrooms and bathrooms, and the functional layout of rooms can affect value.

Age and Condition: Newer properties or those that are well-maintained and updated often command higher prices.

Architectural Style: Unique or desirable architectural styles can add value.

Upgrades and Features: Modern kitchens, bathrooms, energy-efficient windows, and high-quality finishes can increase property value.

Lot Size and Landscaping: Larger lots and professionally landscaped yards tend to be more valuable.

🤘 3. Economic Conditions

Market Trends: The overall health of the real estate market, including supply and demand dynamics, plays a significant role.

🔥 Interest Rates: Lower interest rates generally increase buyers’ purchasing power, potentially raising property values.

🔥 Local Economy: Economic stability and growth in the local area can boost property values.

🔥 Employment Rates: Higher employment rates often correlate with higher property values.

🤘 4. Regulatory Environment

Zoning Laws: Zoning regulations can impact property use and potential, thus affecting value.

✅ Property Taxes: Higher property taxes can negatively affect property values, whereas areas with lower taxes might attract more buyers.

✅ Building Codes and Restrictions: Stringent building codes can increase costs for maintenance and upgrades, potentially impacting property values.

💐 5. Social and Demographic Factors

Population Growth: Areas experiencing population growth often see increased property values due to higher demand.

Demographic Trends: Changes in demographics, such as an influx of younger families or retirees, can influence property demand and value.

☀️ 6. Environmental Factors

Natural Disasters: Properties in areas prone to natural disasters (floods, earthquakes, hurricanes) may have lower values due to higher insurance costs and potential damage risks.

Climate: Favorable climate conditions can enhance property value, especially in regions with mild weather.

🤘 7. Comparable Properties

Recent Sales: Prices of similar properties that have recently sold in the area (comparables or comps) are a key determinant.

Appraisals: Professional appraisals consider various factors to estimate property value accurately.

🏢 8. Future Development

Planned Infrastructure:

Upcoming infrastructure projects like new roads, public transportation, and community developments can increase property value.

Neighborhood Development: Gentrification or revitalization projects can significantly raise property values.

🤘 🤘 Understanding these factors can help both buyers and sellers make informed decisions in the real estate market.

📲 Contact Mukesh Estate Agency 📲 9920466897 | 9870747174 to make this your dream home sweet home! 🏡✨